Let's just say it was a lousy day for the 7-dog trial and leave it at that.

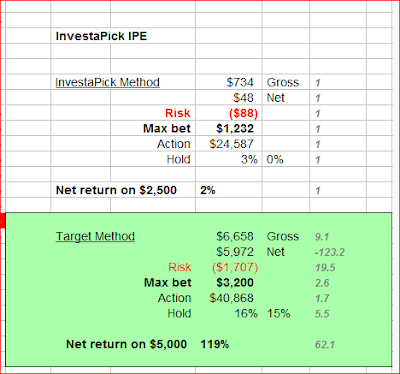

Here are the numbers:

The only bit of good news since Wednesday came from my latest lingering look at the three InvestaPick "funds" going back to the beginning of 2009.

They very strongly suggest that while target betting is a more effective approach than the simple Martingale that IP applies, the selection process may be very nearly as important as betting the right amount at the right time.

I started out last November 1 with a tendency to favor the high end of my +100 to +180 odds range, reasoning that higher paybacks on winners might offset the increased number of losers.

That's because losses cost 100% of the bet (of course) while wins return up to $1.80 on the dollar.

While the 7-dog trial was unfolding, I was adding to my MLB, NFL, NBA and NHL databases, and it became clear that the low end of the range is the safest place to be, more winners paying less edging out fewer winners paying more.

It wasn't a big surprise, so I was not too disappointed.

The IP selections are most frequently on bets rated at -110, meaning that a $100 winning bet returns about a dime less than $191.

The InvestaPick betting strategy is generally easy enough to figure out, except for the IPE fund, which on February 9 this year cut its losses after a $1,232 bet went south, and dropped back to $32.

I am grateful that the Sports Investment Analysts at IP have chosen to post all their results for their three funds going all the way back to January 1 2009 because they gave me some useful numbers to work with.

After yesterday's bets, the comparison between target betting's theoretical performance against the three IP funds vs. actual results posted online day by day looks like this:

One thing that continues to puzzle me is that after winning a redoubled bet (say, +$1,040 at -110 after losses of -$32.50, -$65, -$130, -$260 and -$520), the IP method makes no attempt to recover the chunk of change lost to the bookies' rake.

In the example above, the fund is $1,008 in the hole when makes its $1,040 bet, which wins at -110 and pays $945, leaving a deficit of $65, give or take.

The next bet according to the IP rules is $27.

That means that over time, a substantial number of wins are not really wins at all, because they do not put the bankroll ahead of where it was when the losing streak that just ended first became a threat.

In fairness, the IP strategy is a profitable one.

I am just surprised that it is not even more profitable, as it would be if the value of each bet during a recovery sequence were calibrated to compensate for paybacks known ahead of time to be at less than 100% of the wager.

Perhaps the answer is the old cliche, If it ain't broke, don't fix it.

The IPE fund's failure to recoup its losses in the example I quoted is what caused the big dip in the blue line in the chart above.

Comparative individual results for the three IvestaPick funds are below:

An important reminder: The only person likely to make money out of this blog is you, Dear Reader. There's nothing to buy, ever, and your soul is safe (from me, at least). Test my ideas and use them or don't. It's up to you.

_

No comments:

Post a Comment