The bad news is that while Sunday's sunshine smiled on the bottom line for 5x, 50x still red-lined because most of the wins had piddling returns.

It raises the old question about the long-term wisdom of making each series step up for the collective good when the combined LTD (loss to date) exceeds 7x the minimum bet, 7x being the critical number because we are running seven series or lines per day.

We have already established that 50x is too tight a spread to overcome a DWR (dogs win rate) which for the baseball season to date is quite a bit less than the hoped-for 45%.

At that spread, we are almost $100,000 in the hole and have not seen green ink on the bottom line since February.

Add a zero to the spread (making it x500) and take a zero off the minimum bet (dropping it to $10), and the picture changes dramatically, putting us at above 80% of our best win to date, achieved on June 10.

Requiring each series to bet at least 2% of the collective LTD rather than falling back to a minimum bet after turnaround puts the June 15 win to date at 98% of its best.

All this may be fuel for skeptics who say I keep changing the rules to alter the outcome, but the truth is that I have been making these points - and offering this advice - for decades!

I'm sold on backing underdogs, for sure. The process is so civilized! (No wasted hours at ash-peppered table layouts, fighting an uphill battle against suicidal players who want to take everyone else down with them, or grumpy dealers and suspicious pit bosses...oh, the bliss of it all).

This week's efforts were hampered by a computer glitch that sent my new Toshiba laptop back to Best Buy for a couple of days.

That's a story in itself! The system was under warranty, and according to the BB "Geek Squad" all the hardware checked out fine and required no attention.

Mysteriously, however, in spite of the presence of McAfee anti-virus software, diagnostics found 500 or more "infected files" that would require almost $200 to clean up and eight more days of geek TLC.

I said no thanks to the "disinfectant" and brought the computer home to run tests of my own.

So far, there's no virus anywhere.

I mention all this because Best Buy has been caught before trying to pull a fiscal fast one on customers, and this looks like another classic example.

To wit (or woo): Computers that require warranty work are a drain on the service department's resources because they generate no revenue. Solution: When hardware problems are fixed for free, why not offset that cost by inventing non-existent viruses and make a freebie revenue-productive???

I have no proof of this, of course, but I am sure as hell gob-smacked that not one of 500-plus viruses said by Best Buy to be plaguing my computer can be spotted by virus-sniffing software! (Software that's not being operated by the Geek Squad, that is...).

Here's today's update:-

Saturday, June 19 at 4:10pm

I'm behind start times with today's picks thanks to an odd development in my Toshiba/Best Buy/Geek Squad experience.

Today, after the hardware part of my system was given a clean BoH by the Geeks, my morning began with a rude crash, countless failed attempts at a boot-up, and then (when I finally had all my stuff in front of me) a succession of Windows warnings about an imminent hard drive meltdown.

Best Buy wanted about $100 to back up all my files earlier in the week, and I refused their offer, preferring to rely on the Carbonite account that I set up in late April.

While the Toshiba POC was on a shelf at Best Buy, I tried recovering Carbonite data on a spare laptop, and after much messing about was presented with files that were not current.

So today I sprang for a 1TB backup drive, then had a phone conversation with the Grand Geek in which he conceded that given the relentless "Wait for it...!!!" warnings I have been getting from Windows (along with "Back up NOW!!!") it seems likely that the hardware OK that his guys pronounced was, er, premature.

I'll be closing my Carbonite account, obviously! Why the hell would I want to work on files for the best part of a day only to find that the latest data has not been backed up as promised?

Sorry, folks, had to vent a little.

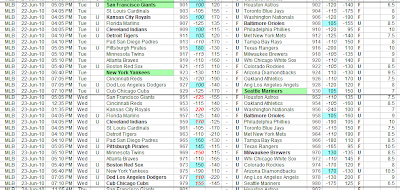

Here are the latest "dog" selections:

Sunday, June 20 at 10:10am

A squeaker again today, timewise...

Tuesday, June 22 at 5:10pm

It's hell being without LAPZILLA!

I just spent the best part of an hour trying to access my blog because although I carefully backed up the Toshiba POC before I handed it over to Best Buy for an HDD replacement, I didn't copy over the encrypted passwords file.

Dummy!

So, today's bets are late AGAIN, with the usual apologies to anyone who looks to me for inspiration about where to venture their wagers.

This has been a truly awful few weeks for MLB "dogs," with the DWR hitting 40% or better on only four days out of 21 so far. Hell's bells...

Obviously, DWRs below about 42.5% day after day after day are going to hurt my chances very badly.

The worm will turn eventually, but will I still be in the game?

Here's today's update:

Wednesday, June 23 at 11:40am

Baseball continues to defy statistical expectation and deliver a DWR that is killing the 7-dog trial...for now!

Tuesday, there were six dog wins in 15 games, but underdogs won both WNBA games at hefty odds.

No use celebrating bets that woulda won if they'd been placed, mind you!

I am a long, long way from understanding how the bookies set their odds, and because the odds are what they are when my money goes down, I am not going to lose too much sleep over that.

The crappy DWR for the baseball season to date is a cause for concern, though.

By the end of the 2009 MLB season, dogs stood at better than 46% after almost 2,500 games, and while that's not a guarantee of anything, this season's 41% after 1,070 contests (give or take) does seem a tad out of whack.

It's not nearly so much of a problem for a sensibly w-i-d-e spread, but the bottom line for 5x and 50x is dripping red ink more and more each day.

I doubt there will be another post before next Tuesday, June 29, because tomorrow I'm off to L.A. for a long weekend and will not have my Toshiba POC with me.

Meanwhile, here's today's update...

InvestaPick continues to sit out the MLB season, and if they were in the habit of backing dogs, that would seem like a smart move.

But since all three IP "sports funds" have been betting the favorite more often than not since the beginning of 2009, that can't be the reason.

Who knows what's going on? I only care because I was having great fun updating their records at the end of each month and seeing how much better InvestaPick's win record woulda been if they had been using target betting instead of a wobbly old Martingale!

An important reminder: The only person likely to make money out of this blog is you, Dear Reader. There's nothing to buy, ever, and your soul is safe (from me, at least). Test my ideas and use them or don't. It's up to you. One more piece of friendly advice: If you are inclined to use target betting with real money against online "casinos" such as Bodog, spend a few minutes and save a lot of money by reading this._