_

Yesterday the 7-dog trial began its unscheduled fourth month with four right picks out of seven and a modest profit of $850.

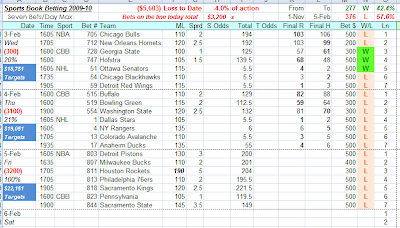

Here's the relevant data, along with selections for today, Tuesday, February 2:

I may be disappointed that we were not able to top the $6,000 best win to date from January 18 before the trial ended its third month.

But the way I see it, I have a lot to be grateful for in lessons learned, and I hope that a few other open minds out there have benefited from the exercise.

Processing the information needed to make each day's underdog selections and then post them here takes just a few minutes every morning, so I have had plenty of time to look much further back than the trial's November 1, 2009 start date.

I always believed that narrowing the "qualifying" range from its present +100-180 would logically reduce risk and improve the overall win rate in percentage terms.

But what I did not and could not assume was that the overall win value would not suffer as a result of excluding wagers with substantially higher paybacks.

Losses are of course always 100% of the bet value, and fewer of them is a good idea.

But wins at 180% of the sum ventured are logically preferable to wins that cannot top 150% or 125% or whatever the odds ceiling enforced might happen to be.

There is a lot more work to be done on this as my multi-sport databases expand, but here's a screen snip that speaks volumes, the way I'm hearing it...

I have been accused more than once of being obsessed with models and analysis at the expense of real-time, real-money play, and I proudly plead guilty to preferring educated guesses to ignorant ones.

What I have found so far is that since the beginning of the 2009 baseball season through the expiring NFL season and now the NBA and NHL seasons through last week, there have been 3,199 underdog options that met my original +100 to +180 odds range.

The top end of the range was an arbitrary selection only partly influenced by the logical assumption that at some point, odds become too long to be worth the risk.

Applying target betting rules modified for sports book wagering (in short, a less aggressive method than the one developed for table games with a sustained negative expectation) would have brought a profit of about $110,000 in 300 days.

At one point, the win would have exceeded $200,000 - but at another point, backing dogs as long as +180 would have put us more than $150,00 in the hole.

That, obviously, is not acceptable!

Trimming the top number from +180 to +150 "woulda" excluded 625 potential dog wagers, delivering a win of $117,000 to date against a maximum exposure of $23,330 and a best win of more than $225,000.

Tightening the qualifying range still further to +120 max would have cut out another 900+ bets.

It would also have given us a win to date of $97,000 in 300 days (94% of the best win to date) and maximum exposure of $24,000.

I should explain "maximum exposure": The term refers to a worst case scenario, or the greatest risk in any one series at any time, and the bankroll may at that point exceed the notional exposure.

And now by way of almost changing the subject...

I ran some more tests on the three Investapick lines yesterday, and the only mistake I found (a game that according to one source did not take place) turned out to be a schedule error, not IP's.

All of the spot checks I ran matched Investapick's bet selections, odds quoted and final results shown.

There was just one grey area, where skipped days coincided with an ongoing losing streak, suggesting to the kind of cynics whom I have to deal with all the time that "maybe" losses were deliberately omitted to hide the streak's true length.

To me, that seems unlikely, given that selections are posted every day and investors with real money in one or more of the three "funds" have access to Investapick's records that I do not.

I have already established that if target betting's rules were to be applied to the IP selections, the win to date would in each case be at least two and a half times greater.

But that's a discussion for another time!

As I have said before, my primary problem with the IP method is that partial losses caused by paybacks at less than 100% are not recovered.

In dollar terms, it's a relatively piddling concession when the bet is less than $50 and the bookie's gouge amounts to a mere $5 at most.

But after five successive losses, calling for a bet above $1,000 in pursuit of turnaround, odds of -110 (the number most often seen in the IP data) on a win trim the bankroll by almost $100 that cannot be recovered under the IP rules.

All in all, I find the Investapick package pretty darn impressive.

And if there are real people out there enjoying gross returns of 100% a year or better on their $2,500 investments, they must be happy with it too.

Wednesday, February 3 at 3:25pm

Baby steps in the right (upward!) direction yesterday, with three right picks out of seven.

More of the same today, hopefully.

Here's the latest summary, with Wednesday's bets clearly shown:-

Thursday, February 4 at 11:15am

So far, this week has been like a walk on a windy day in Chicago - a few steps forward, a few steps back.

Dogs have been soundly thrashed of late, which makes for miserable bookies but pumps up punters no end.

It's just as well, because backing favorites all the way since the beginning of the 7-dog trial would have us $3,925 in the hole in spite of a win rate of 57.1%.

What's the difference?

The difference is that underdogs will recover. Favorites have been in the mire almost since Day One of this trial!

Today's updates:

Friday, February 5 at 9:15am

Thursday was an unmitigated nightmare, with dogs barely managing to win 20% of their games for the second day in succession.

The only bit of good news about the current slump is that it is not yet the longest since the 7-dog trial began 96 days ago!

Yesterday was the first flat-out skunking, with nary a win in sight, and it took us to the lowest point since the trial (a word that now takes on a different meaning!) began.

The longest slump began less than three weeks in and dragged on for more than a month, so there is some hope to be gleaned there, perhaps.

Unrecovered LTDs are now well into five figures, and as long as I keep the max at a mere 5x the min, full turnaround will not be possible.

But I still believe we can wrap this thing up with a win greater than the $6,000 that had accrued by January 18.

Here are the current numbers...

Saturday, February 6 at 8:50am

A modest rebound yesterday (+$550), but these days I'll take whatever comes!

Dogs finally came close to the 45% win rate that I expect of them, and which is demonstrably inevitable in the long run.

It is worth noting that to reach that DWR in this trial, underdogs would need to notch up at least 15 successive victories.

Given paybacks averaging +126 to date, that would be more than enough to blow away the current red number and replace it with a big fat green one not too far below the best win to date (+$6,000 on January 18).

It will happen - a return to 45%, not 15 successive wins! - but when you're stuck down a deep, dark hole, waiting for rescue, not knowing when can be almost unbearable.

A big day today: eight qualifying dogs on the NBA schedule with more likely as the odds trim closer to game time, and 11 under the NHL banner.

Here are today's numbers:-

Sunday, February 7 at 9:55am

Saturday was pretty much a wash for the 7-dog trial: three right picks covered the losses from four wrong ones but for $200.

Tough to find seven selections today, but I could hardly ignore the Super Bowl, even with the Saints at the top end of a range that I have learned from this trial is several notches too wide!

Here are the numbers...

It's a whole lot clearer than mud that this is the worst slump that the 7-dog trial has suffered since it began last November 1, and I have to concede (at least for now!) that even a partial turnaround seems unlikely...with a 5x ceiling in place, anyway.

But dogs will rebound, as they always do, and maybe when the DWR moves back into its comfort zone, it will give us the boost we need to call this limited trial a success. Finally!

An important reminder: The only person likely to make money out of this blog is you, Dear Reader. There's nothing to buy, ever, and your soul is safe (from me, at least). Test my ideas and use them or don't. It's up to you.

_

No comments:

Post a Comment