Boy, some people are never satisfied!

It is a fact, though, that dropping individual lines/series back to a minimum bet when they have turned around but others are still struggling substantially slows down the overall rate of recovery.

So, as I have said before, next time I will set the spread higher (at least 20x) and will force winning series to contribute to the collective win target.

The slump we are in right now is the third in as many months, and the other two were relatively short-lived.

Models of the method now in use (with actual sports results applied, as always) confirm that given the optimal paybacks that are seen whenever the dog odds exceed +100, recovery from any slump is just a matter of time.

Time does not matter in a simulation, but it sure as hell does when each day lasts a full 24 hours and a bad week like last week can seem to drag on for a lifetime.

I take consolation in the fact that the 7-dog trial is still ahead to the tune of about $500 a month, while a punter putting his precious pennies on favorites would be drowning in red ink by now. (See the last chart below).

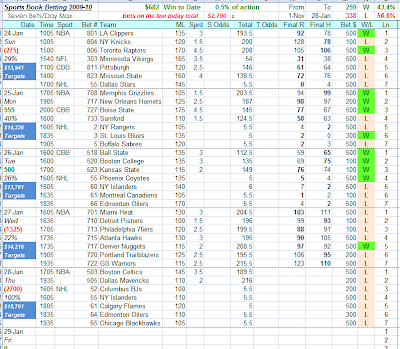

Here are the latest summaries, with bets for today, Tuesday, January 26:-

Wednesday, January 27 2010 at 1:15pm

Talk about deja vu all over again...just like Monday, Tuesday brought four right picks out of seven, with the win for the day ($500) crimped by minimum bets on two of them.

Hey, at least we are moving upward again.

For a while there, even I started to worry that the recent slump might never end.

Now all we need is five days of the same 4/7 and we will push the green line on the chart back to where it ought to be.

Today's updates:

I have been doing some more work on data from the sports fund that Pete pointed me at a few weeks back, and I think it's time I stopped being coy and named the website so that those of you who want to can check it out for yourselves.

It's called Investapick, so you can find it at http://www.investapick.com/.

I remain very impressed, if a little puzzled that given a rate of return that is generally 91 cents on the dollar or less (vs. a full buck down the drain for a loss), no effort is made to compensate for the shortfall.

The beauty of a source like this is that all the data is verifiable, because the creators of the concept have been very smart and made bets for the last year or so in three separate lines totally transparent.

My pal Pete had his girl spend a Friday and part of a Saturday transcribing results from another far less promising sports betting fund, whereas it takes just a few minutes to block copy and paste Investapick's data.

When compared with almost any other investment option available today, Investapick's returns should be taken very seriously indeed.

Before I go any further, I should say that I have no connection whatsoever with this outfit, and should perhaps be treating them as a competitor rather than a source of inspiration!

Each of the betting blocks requires a minimum investment of $2,500 and the website shows 13-month returns of at least 100% across the board.

Some people will have reservations about a very simple betting method that only minimally increases the wager after a win, and relies on doubling up (a Martingale, perish the thought!) in response to a loss.

Given the fund's preference for picking favorites whenever the price is right, more often than not betting the spread or total rather than the moneyline, six consecutive losses is a rare losing streak.

In fact, in the three separate data sets, five wrong picks in a row was as bad as it ever got, making the greatest exposure at any one time $2,048 ($1,008 in the hole plus the $1,040 bet needed to get out of it).

I would do things a little differently, as you might guess.

I would limit the number of double-ups, press a little harder during a winning streak, and target the earnings lost to paybacks below 100%.

The effect of my changes would be something like this:

In sum, greater risk, bringing a greater reward.

But in fairness, there is nothing wrong with the method Investapick is using now.

If the data is accurate - and I believe it is - it's a testimonial to the wisdom of the old saying, If it ain't broke, don't fix it.

I owe thanks to "Pete" for prodding me in the direction of Investapick in spite of my protests that backing mostly favorites could not possibly pay off, and to the Investapick team for providing me with some very helpful data.

Meanwhile, I plan to remain faithful to those underdogs. Hell, someone has to stand up for the little guy...

Thursday, January 28 at 2:05pm

Ouch!

The less said about yesterday's dogs, the better. The charts below tell a sad tale...

Once in a while I get flamed (to use ancient Internet argot) for manipulating data until I get the results I want.

While I am constantly enthralled by the what if capabilities of spreadsheets, which is why I started working with them back in the days of CP/M and Supercalc, I plead not guilty to cooking the books.

I have been saying for years that if target betting did not keep proving itself viable over and over again against all manner of objective data, I would have abandoned this quest decades ago.

Last time, I talked about the method's success against the equivalent of three years' worth of data from InvestaPick, and today I applied the same rules to the 7-dog trial results collected since November 1 last year.

What I needed to know was how much of a drag a spread limited to 5x the inimum really is.

I said before that I plan to bump the spread to at least 1 to 20 next time, so let's look first at numbers for 5x, then 20x.

These outtakes are informative, but don't show how the different bet limits performed day by day, with seven series combined.

So let's look at that comparison:-

None of this effort on my part is directed at fooling anyone, least of all myself.

There is nothing deluded or deceptive about studying the past, learning from it, and using it to improve our response to present and future challenges - since we are working in the sports arena, ask any coach, player or handicapper about that!

What we are not allowed to do is rewrite history by fiddling with the past to make it conform to an otherwise unproven plan for the future.

If I were a fool, I would not care about accuracy or ethics or any of the rules that bear on a discipline as complex as mathematics.

But in spite of what my critics sometimes say about me, I'm no fool, and all I ever pass on to those who are interested is the truth as I find it, not as I want it to be!

Here's one last screen shot, showing a 1 to 50 spread (a piddling range in comparison with what's required when target betting takes on casino table games).

Ignore what I tell you if you prefer - it's still a free country - but please don't accuse me of cheating.

Friday, January 29 at 1:00pm:

Nasty old business, Thursday...

"Success has many fathers; failure is ever an orphan."

I guess if that's true, now that both 7-dog summaries (the real-money one and its more aggressive shadow) are back in the red, I have to stop saying "we" and stick with "I".

So...I'm struggling right now, and disappointed that what should have been the trial's 13th and final week is almost certain to end on a sour note.

I don't doubt that the numbers will bounce back to a new high in due time, and I will press on until that happens.

Still and all, it would have been neat to hit the targeted final day on January 31 with some big green numbers at the top of the summary, instead of all that red ink.

I have re-learned a couple of useful lessons from this real-time, real dough experiment.

I knew from the models that 1 to 5 was too narrow a spread and that betting dogs with odds longer than +125 could be hazardous.

But here's nothing like placing seven bets, then waiting half a day or more for the outcomes, to highlight truths that seem somehow less relevant when the analysis is purely theoretical.

There will be better days again, that I'm sure of.

Saturday, January 30 at 10:00am:

The tough times are still with us...

All I can do at this point is wait, and in the meantime try not to whinge too much!

Yesterday, there were just two underdog wins in 18 games, so catching one of them amounts to an achievement of sorts.

And obviously, there's no way a dog-centered betting strategy can make headway as long as favorites maintain an 89% win rate!

Here's today's update:

Today's win to date (OK, loss to date) number is less than one minimum bet shy of the deepest hole we've dug since November 1.

Let's hope today's picks give us a boost in the right direction.

Sunday, January 31 at 10:00am:

Saturday was the first winning day we have had in a while, with a profit of $975 making a small dent in $5,730 in losses last week.

It's a start, but even if all seven dog picks come home with their tails wagging today, it will not be possible to end the 7-dog trial with a best win to date number.

So, I'll stick with the current rules and format until the current down trend turns around, as I remain confident that it will.

Our best WTD was on January 18 and was a few pennies shy of +$6,000. Now, mid-month seems a lifetime away!

Here are the latest summaries and today's picks...

Monday, February 1 at 9:50am:

So, the 7-dog trial ended its third month at its lowest point to date, and Saturday's wins turned out to be a wasted climb up the knotted rope and out of the hole.

Disappointing, of course, but I am not about to abandon this effort because of just one frightful fortnight.

We peaked on January 18 at +$6,000 and have barely looked ahead since.

Dognostics will, of course, herald Sunday's debacle as proof that this whole concept is doomed.

To me, that would be like saying that three bad months on Wall Street would negate all past profits and "prove" that stocks and bonds add up to a voracious money pit that only benefits brokers.

Oh, wait...

But seriously, I have run out of witty and insightful (or even relevant) things to say as this slump continues, so from now on I will confine myself to daily posts of the updated summary and current bets.

There will be other topics, but the 7-dog trial will eventually take care of itself and I will try to keep my feverish fingers away from further comment until I have something positive to report.

On my agenda this week is additional study of the InvestaPick "Sports Investment Analysis" service.

I have downloaded most of the data from January 1, 2009, that can be found on the website, and have found no red flags so far.

A couple of things do concern me, though.

There is prominent reference to the Financial Times, but there is no link to the article that prompts the "as featured in..." claim, and a search of the FT archives failed to find it.

The FT search engine refuses queries predating January 1, 2005, and since InvestaPick says it has been in business since 1999, that could be the answer.

Finally, all three sports funds featured have sit-out or skip days from time to time.

It may well be that there were simply no suitable bets on those blank days (I know how that can happen!).

But if the skips consistently coincide with prolonged downturns, then there may be cause for concern.

I also find it odd that a service that claims annual returns exceeding 100% has been largely omitted from Internet chatter over the past decade.

Alexa's website analysis service gives InvestaPick almost 4 million hits a month, which is a healthy number by any standards.

The company itself claims to have developed a winning method that has been enriching its clients since the tail end of the 1990s, but posts just a half dozen testimonials on its website.

Perhaps that's just modesty and discretion?

Here's the latest from the 7-dog trial:-

_

An important reminder: The only person likely to make money out of this blog is you, Dear Reader. There's nothing to buy, ever, and your soul is safe (from me, at least). Test my ideas and use them or don't. It's up to you.

No comments:

Post a Comment