Wednesday was another dismal day.

But we're in this for the long haul, right?

Tuesday was the pits with just two right picks, but we headed south again yesterday with ONE right bet and six wrong 'uns.

The DWR also dropped from 20% to 19%. Ouch!

No use crying over spilt money. It will come back in time, as always.

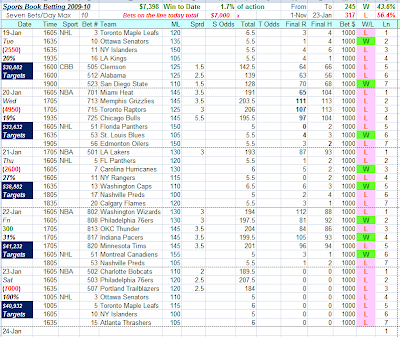

Here's the relevant info:-

Next time I do this (and there will be a next time) I won't permit bets in a given series to fall all the way back to the minimum after the LTD for that series has been recovered.

It has proved to be too bad for (my) morale to have all of a day's wins coincide with bets far below the max when there are still other targets to be achieved.

And the spread will be at least 10x. Recoveries take too long with a spread as tight as 1 to 5, although I guess the upside is that when you are headed to hell in a handcart (or is it handbasket?) as we are right now, you lose less.

Today brought some good news, at least.

I heard from my pal Pete in foreign parts that while I wasn't paying attention, he managed to recover all his $7,000 or so in losses from last fall and climb back into the black again.

He is now using a bet selection (or 'Capper?) service that claims a win rate of 75% plus, and Pete sent me a year's worth of data that put its long-term win rate at 83%.

Wow!

He managed to lose all that money while ignoring my advice and won it back using the same tactic, so I am feeling sadly out of the loop.

However, with a selection process that routinely picks three right bets out of four, who needs a strategy?

Good work, Pete. I just wish I knew how you did it.

Friday, January 22 at 3:50pm:

Thursday was not a whole lot better than the day before, and the 7-dog trial dropped a few more bucks thanks to a DWR of 27%.

Not much I can say about that, really.

There are good days and bad days, and after some good ones, we're headed south for a while.

What goes down must come up when the math is on your side!

Here are today's bets and Thursday's results:-

A couple of minor changes to the format in response to complaints that, as in the Google spreadsheet, the "targets" summary looks too much like a loss to date.

The current state of the bankroll is at the top of the screen snap in each summary, along with the percentage of the total action to date and other useful numbers.

Now, the targets total on the far left in each day's panel seems much less depressing.

Add the day's value to the running total at the top and you will have an idea of where the 7-dog trial will stand when all outstanding targets are achieved.

Saturday, January 23 at 9:50am:

When you're hit, you're hit, and when you're not, tough 'taters.

I will be glad when this week is over, especially if underdogs manage to bounce back a little before we hit that thin line between profit and loss.

Today's post is all about visual aids.

As always, click on any image to make it actually legible.

The screen shots below should be self explanatory, but there's a little extra help below each for those who need it...

As things stand, we are at what I hope will prove to be the southernmost end of our third major slump since the 7-dog trial began almost three months ago.

We have three lines in profit, three in the red, and one somewhere in between.

The only good news is that the patterns shown in the bottom chart (the wiggly lines, not the bars) match both logical and statistical expectation.

The final chart for today simply presents the same information slightly differently.

They all tell the same story: We have had better weeks!

And we will again...

Sunday, January 24 at 9:05am:

Yesterday was an un-great day (DWR 27%) made worse by the fact that one of our three dog wins was at $100.

I would be happier placing no bets at all today, given the limited options and consequent long odds, but the 7-dog trial is on the home stretch and I decided that another betless day would be just too sad!

I do know that next time I do this, starting from scratch on February 1, I won't fall back to a minimum bet in any series if any of the others has a substantial LTD dragging it down.

The days of a 1 to 5 spread are similarly numbered.

One of the crosses I have to bear with this target betting blog is that whenever real-time practicality encourages me to make a change in the strategy, skeptics holler that I am raising the bet limit (or whatever) because beating the odds is a long-term impossibility.

But what this is actually about is evolution, and that is a far cry from admitting defeat.

Here are today's updates:

Monday, January 25 at 1:15pm:

We took another hit Sunday, leaving our win to date at a little less than $1,000 and prospects looking dim, at least for now.

Then again, only those of us with crystal balls can say what the short-term future holds!

This week is the last one scheduled for the 7-dog trial, next Sunday being the 31st, but if we're not seriously in profit by then, I will just keep this thing going until the inevitable turnaround finally comes along.

There is no doubt in my mind that it will happen. I just don't know when.

Whenever it occurs, I will wrap up the trial under the present set of rules, and start a new one with a wider spread and a few other minor tweaks and twiddles.

Ironically, if I had done as one dognostic suggested and backed every qualifying underdog (with odds between +100 and +180) every day, profits would be significantly higher.

I will supply full details later - I don't see much sense in offering a comparison until the checkered flag has come down for the last time.

I know ahead of time that a modified rules set will draw the scorn of many of the skeptics out there.

What they don't seem to understand is that in betting, as in life, stubbornly sticking with an approach that you know could be improved is a self-defeating policy.

I am much encouraged by what I see with the only "sports fund" I have bothered to fully analyze.

The fund provides verifiable data that shows 100% or better returns for each of three separate lines or series dating back to January 1, 2009.

Beat that, Wall Street! (although when I say that, I am obviously not talking to the recipients of those huge bonuses we keep hearing so much about...what does any of them need with an investment strategy?).

Here's the latest data...

An important reminder: The only person likely to make money out of this blog is you, Dear Reader. There's nothing to buy, ever, and your soul is safe (from me, at least). Test my ideas and use them or don't. It's up to you.

_

No comments:

Post a Comment